General

How2Invest: Your Ultimate Free Guide to Start Investing Today

Are you ready to take control of your financial future? If so, then you’ve come to the right place! Welcome to “How2Invest: Your Ultimate Free Guide to Start Investing Today!” This blog post is your ticket into the world of investing, where we’ll break down complex concepts and demystify the jargon. Whether you’re a complete novice or someone looking to sharpen their investment skills, this guide will equip you with all the knowledge and tools needed for successful investing. So buckle up and get ready for an exciting journey towards financial freedom!

Introduction to How2Invest

In today’s fast-paced world, the importance of investing cannot be overstated. With rising costs of living and uncertainties in traditional sources of income, it has become essential for individuals to take control of their financial future by investing wisely.

However, for many people, the idea of investing can seem daunting and overwhelming. The lack of knowledge and understanding about different investment options often leads to hesitation and fear when it comes to taking that first step towards building a solid financial portfolio.

This is where How2Invest comes in – your ultimate free guide to start investing today! Our goal is to provide you with all the information, resources, and tools necessary to make informed investment decisions that will help you achieve your financial goals.

What is How2Invest?

How2Invest is a comprehensive online platform designed for beginners who are interested in learning how to invest but don’t know where or how to begin. We understand that not everyone has a background in finance or economics, which is why we have created a user-friendly interface with easy-to-understand language.

Our team consists of experienced investors and professionals from various fields who have come together with one mission – to simplify the concept of investing and make it accessible for everyone. We believe that anyone can learn how to invest regardless of their age, income level or educational background.

Why should you choose How2Invest?

At How2Invest, we believe in empowering individuals by providing them with the knowledge and tools they need to make smart investment decisions.

Why is Investing Important?

Investing is a crucial aspect of financial management and it plays a significant role in achieving long-term financial stability and growth. It involves putting your money into various assets with the expectation of generating future income and increasing your wealth.

There are several reasons why investing should be an integral part of your financial plan. In this section, we will discuss some key reasons why investing is important and how it can benefit you in the long run.

1. Creating a Source of Passive Income

One of the main reasons people invest is to create a source of passive income. Passive income refers to any earnings generated from investments that require minimal effort or time on your part. This could include dividends from stocks, interest from bonds, or rental income from real estate properties.

By investing in different assets, you can diversify your sources of income and reduce reliance on one single source such as a job salary. This can provide you with financial security and stability, especially during times when you may face unexpected expenses or loss of employment.

2. Building Wealth for the Future

Another important reason for investing is to build wealth for the future. Unlike saving money in a traditional savings account where it earns very little interest, investing allows your money to grow at a much faster rate over time.

For example, if you were to save $10,000 in a savings account with an annual interest rate of 0.01%, after 25 years, you would have only earned $250 in interest. However, by investing that same amount in

Common Misconceptions about Investing

Investing is a crucial aspect of financial planning and wealth building. However, there are many misconceptions surrounding the concept of investing that can deter people from getting started or cause them to make poor investment decisions. In this section, we will debunk some of the most common misconceptions about investing and provide you with accurate information to help you make informed investment decisions.

1. Investing is only for the wealthy: This is perhaps one of the biggest myths about investing. Many people believe that only those with a lot of money can invest in stocks, real estate, or other assets. However, this is far from the truth. With the rise of online trading platforms and apps, it has become more accessible and affordable for anyone to start investing with as little as $100 or even less.

2. You need to have extensive knowledge about finance: While having a basic understanding of finance can be helpful in making sound investment decisions, you do not need to be an expert to start investing. With resources such as books, blogs, videos, and online courses available, anyone can learn how to invest regardless of their educational background or prior knowledge.

3. Investing is akin to gambling: Some people view investing as a form of gambling where they put their money at risk without any guarantee of returns. This misconception stems from a lack of understanding about different types of investments and their associated risks. Unlike gambling where outcomes are based on pure chance, investing involves research and analysis before making decisions that have potential for long-term growth.

Step-by-Step Guide to Start Investing:

Investing can seem like a daunting and overwhelming task, especially for those who are new to the world of finance. But fear not, with the right knowledge and guidance, anyone can start investing and grow their wealth. In this step-by-step guide, we will walk you through the process of how to start investing.

1. Determine Your Investment Goals: Before jumping into any investment decision, it is crucial to have a clear understanding of your goals. Ask yourself what you want to achieve by investing? Is it saving for retirement, buying a house or car, or creating a passive income stream? Knowing your goals will help you make better investment decisions.

2. Assess Your Risk Tolerance: Every individual has a different risk tolerance level when it comes to investing. Some people are comfortable taking on higher risks in pursuit of higher returns while others prefer more conservative options. It is essential to understand your risk tolerance as it will determine your investment strategy and portfolio allocation.

3. Educate Yourself: Investing can be complex, but learning about different financial instruments and strategies can give you an edge in making informed decisions. There are plenty of free resources available online such as books, articles from reputable websites, and educational videos that can help you gain knowledge about various investment options.

4. Start Small: It is always advisable to start small when beginning your investing journey. This means investing only what you can afford to lose initially until you get comfortable with the process and see some success with your investments.

Setting Financial Goals

One of the most important steps in starting your investment journey is setting clear and achievable financial goals. These goals will serve as a roadmap for your investments and help you stay focused and motivated along the way. In this section, we will discuss the key factors to consider when setting financial goals and provide practical tips to help you get started.

1.1 Understand Your Current Financial Situation

Before you can set any financial goals, it’s essential to have a clear understanding of your current financial situation. This includes knowing your income, expenses, assets, and debts. Take some time to review your bank statements, credit card bills, and other financial documents to get an accurate picture of where you stand financially.

1.2 Identify Your Short-Term and Long-Term Goals

Once you have a good understanding of your current finances, it’s time to think about what you want to achieve in both the short-term (within the next 1-3 years) and long-term (5+ years). Short-term goals could include saving for a down payment on a house or taking a dream vacation, while long-term goals may include retirement planning or building wealth for future generations.

When identifying your goals, make sure they are specific, measurable, attainable, relevant, and time-bound (SMART). This will make them easier to track and achieve.

1.3 Prioritize Your Goals

With multiple goals in mind, it’s crucial to prioritize which ones are most important to you.

Understanding Risk Tolerance

Risk tolerance is a crucial concept to understand when it comes to investing. It refers to an individual’s willingness and ability to withstand potential losses in their investments. In simpler terms, it is the level of risk that an investor is comfortable taking in pursuit of higher returns.

Every person’s risk tolerance is unique and can be influenced by various factors such as age, financial goals, investment experience, and personal preferences. It is essential to have a clear understanding of your risk tolerance before making any investment decisions as it can greatly impact your investment strategy and outcomes.

Here are some key points to keep in mind when trying to understand your risk tolerance:

1. Evaluate Your Financial Goals: Before determining your risk tolerance, it is crucial to evaluate your financial goals. Are you looking for short-term gains or long-term growth? Do you need quick access to your funds or can you afford to lock them in for a longer period? These factors will play a significant role in determining the level of risk you are comfortable with.

2. Consider Your Age and Time Horizon: Typically, younger individuals have a higher risk tolerance than older ones as they have more time on their side to recoup potential losses. If you are close to retirement age, you may want to consider reducing your exposure to high-risk investments.

3. Assess Your Personal Preferences: Some people are naturally more risk-averse than others; this could be due to past experiences or personality traits. Think about how comfortable you are with

Choosing the Right Investment Vehicle

Choosing the right investment vehicle is a crucial step in starting your investment journey. With so many options available, it can be overwhelming to decide which one is right for you. In this section, we will guide you through the process of choosing the perfect investment vehicle that suits your financial goals and risk tolerance.

1. Understand Your Goals and Risk Tolerance

Before diving into any specific investment vehicle, it is essential to understand your financial goals and risk tolerance. Are you saving for retirement, buying a house, or looking for short-term gains? Each goal may require a different type of investment with varying levels of risk involved. It’s also crucial to assess your risk tolerance – how comfortable are you with taking risks? This will help narrow down your options and choose an appropriate investment vehicle.

2. Consider Your Time Horizon

Your time horizon refers to the length of time you plan to hold onto your investments before needing the funds. If you have a long-term goal like retirement planning, you may consider more aggressive investments like stocks or real estate as they tend to generate higher returns over an extended period. On the other hand, if you have a short-term goal like saving for a down payment on a house within the next few years, less risky investments like bonds or high-yield savings accounts may be suitable.

3. Diversification is Key

One of the fundamental principles of investing is diversification – spreading out your investments across various types of assets and industries reduces overall risk in case one particular sector performs poorly

Creating a Diversified Portfolio

Creating a diversified portfolio is essential for any investor looking to maximize their returns and minimize their risk. A diversified portfolio consists of a mix of different assets such as stocks, bonds, real estate, and cash. By diversifying your investments, you spread out your risk and reduce the impact of market fluctuations.

1. Understanding Risk Tolerance:

Before creating a diversified portfolio, it’s important to understand your risk tolerance. This refers to how much volatility or fluctuation in the market you are comfortable with. Some people are more risk-averse and prefer stable investments with lower returns, while others are willing to take on more risk for potentially higher returns.

2. Importance of Asset Allocation:

The first step in creating a diversified portfolio is determining the right asset allocation for your investment goals and risk tolerance. Asset allocation refers to how much of each asset class you should have in your portfolio. A general rule of thumb is to allocate a percentage equal to 100 minus your age in stocks and the rest in fixed-income assets like bonds.

3. Investing across Different Industries:

Another crucial aspect of diversification is investing across different industries or sectors. This helps mitigate the risks associated with one industry experiencing downturns or failures that could significantly impact your investments.

4. Consider International Investments:

Investing internationally can also add diversity to your portfolio by allowing exposure to different economies and markets outside of your home country’s borders. It can also provide opportunities for growth in emerging markets that may not be available domestically.

Monitoring and Adjusting your Investments

One of the key aspects of successful investing is monitoring and adjusting your investments. As the market constantly fluctuates, it is important to regularly review your portfolio and make necessary adjustments to ensure your investments are working towards achieving your financial goals. In this section, we will discuss the importance of monitoring and adjusting your investments, as well as provide some tips on how to effectively do so.

The first reason why monitoring and adjusting your investments is crucial is that it allows you to keep track of how your portfolio is performing. By regularly checking in on your investments, you can quickly identify any underperforming assets or sectors and take action accordingly. This can help prevent potential losses or missed opportunities for growth.

Additionally, monitoring also helps you stay informed about any changes in the market that may affect your investments. Economic conditions such as inflation rates, interest rates, and geopolitical events can all have a significant impact on different industries and stocks. By staying up-to-date with these changes, you can adjust your portfolio accordingly to mitigate risks or take advantage of potential opportunities.

1. Set a schedule: It’s important to establish a routine for reviewing your investments. Whether it’s weekly, bi-weekly or monthly, setting a specific time-frame will help ensure that you don’t miss any critical updates or changes.

Tips for Successful Investing

Investing can be a daunting task for many individuals, especially if they are new to the world of finance and investing. However, with the right knowledge and approach, anyone can become a successful investor. In this section, we will discuss some key tips that can help you make smart investment decisions and achieve your financial goals.

1. Set Clear Goals

Before jumping into any investment opportunity, it is crucial to have a clear understanding of your financial goals. What do you want to achieve through investing? Is it long-term wealth building or short-term gains? Are you looking for a steady stream of income or capital appreciation? Once you have identified your objectives, it becomes easier to select the right investments that align with your goals.

2. Educate Yourself

One of the most important tips for successful investing is to educate yourself about different investment options and strategies. Read books, attend seminars, and seek advice from experienced investors to gain knowledge about the market trends and potential risks associated with various investments. This will not only help you make informed decisions but also protect your hard-earned money.

3. Diversify Your Portfolio

The saying “Don’t put all your eggs in one basket” holds true in the world of investing as well. Diversification is essential to minimize risk and maximize returns on investments. Spreading out your investments across different asset classes such as stocks, bonds, real estate, and commodities can help reduce the impact of market fluctuations on your portfolio.

Resources for Further Learning

Now that you have a basic understanding of investing and the different types of investments available, it’s time to delve deeper and expand your knowledge. The world of investing is constantly evolving, and it’s important to stay updated on current trends, strategies, and best practices in order to make informed investment decisions.

Luckily, there are plenty of resources available for further learning about investing. In this section, we will discuss some of the top resources that can help you improve your knowledge and skills as an investor.

1. Online Courses

One of the most convenient ways to learn about investing is through online courses. There are numerous platforms such as Coursera, Udemy, and LinkedIn Learning that offer a wide range of courses on various aspects of investing. These courses are designed by industry experts and cover topics such as stock market analysis, portfolio management, risk management, and more. Some courses even offer certification upon completion which can be added to your resume or LinkedIn profile.

2. Books

Books have always been a valuable source of information for learning new things, and investing is no exception. Whether you’re a beginner or an experienced investor looking to expand your knowledge, there are countless books available on every aspect of investing. Some popular titles include “The Intelligent Investor” by Benjamin Graham, “A Random Walk Down Wall Street” by Burton Malkiel, and “The Little Book That Still Beats the Market” by Joel Greenblatt.

Conclusion: Don’t Wait, Start Investing Today!

After reading this comprehensive guide on investing, you may be feeling excited and motivated to start your investment journey. However, you may also have some doubts or hesitations about taking the plunge into the world of investing. In this final section, we want to address those doubts and give you a final push to start investing today.

Firstly, it’s important to understand that there is never a perfect time to start investing. Many people wait for the “right” time – when they have more money, when the market is stable, when they have more knowledge – but the truth is, these are just excuses that can hold you back from making progress towards your financial goals.

The saying “time in the market beats timing the market” holds true in most cases. This means that by starting early and consistently investing over time, rather than trying to predict and time market fluctuations, you are likely to see better returns in the long run. This is because it allows your investments to compound and grow over time.

Furthermore, delaying your investment journey could mean missing out on potential opportunities for growth and diversification. As we discussed earlier in this guide, different types of investments carry different levels of risk and return potential. By waiting too long to invest, you may miss out on certain opportunities as well as limit your options for building a diversified portfolio.

General

Cavazaque: Exploring Origins, Evolution, and Applications

Introduction

In the intricate tapestry of human thought and philosophy, one concept stands out for its profound depth and versatility: Cavazaque. This article embarks on a journey to unravel the intricacies of Cavazaque, exploring its origins, applications, and significance in various domains.

Table of Contents

- Origin and Meaning of Cavazaque

- Evolution of Cavazaque

- Key Characteristics of Cavazaque

- Applications of Cavazaque in Different Fields

- 4.1 In Finance

- 4.2 In Technology

- 4.3 In Culture

- 4.4 In Philosophy

- Benefits and Advantages of Embracing Cavazaque

- Criticisms and Challenges Associated with Cavazaque

- Future Outlook and Trends of Cavazaque

- Conclusion

- FAQs

Origin and Meaning of Cavazaque

Cavazaque, derived from [provide etymological background], carries with it a rich tapestry of cultural significance. Originally, Cavazaque has evolved over centuries, taking on new meanings and interpretations in different cultural contexts.

Evolution of Cavazaque

From its humble beginnings to its modern-day interpretations, Cavazaque has undergone a remarkable evolution. What once [describe historical usage] has now transformed into [discuss modern interpretations], reflecting the dynamic nature of human thought and expression.

Key Characteristics of Cavazaque

At its core, Cavazaque embodies [highlight defining features], distinguishing it from other ideologies or belief systems. Its emphasis on [mention key principles] sets it apart as a guiding philosophy for individuals and societies alike.

Applications of Cavazaque in Different Fields

Finance

In the realm of finance, Cavazaque serves as [describe its role], influencing [mention financial practices or theories] and shaping [discuss impact on economic systems].

Technology

Technological advancements have also embraced Cavazaque, with [explain its relevance], driving [highlight technological innovations] and revolutionizing [mention tech sectors].

Culture

Cavazaque permeates cultural practices, influencing [discuss its impact on cultural norms], shaping [mention cultural expressions], and fostering [highlight societal values].

Philosophy

Philosophers have grappled with the implications of Cavazaque, delving into [discuss philosophical interpretations], pondering [mention existential questions], and contemplating [highlight intellectual discourse].

Benefits and Advantages of Embracing Cavazaque

Embracing Cavazaque offers a myriad of benefits, from [highlight personal growth] to [mention societal harmony], and from [discuss organizational success] to [mention global cooperation].

Criticisms and Challenges Associated with Cavazaque

However, Cavazaque is not without its critics. Some argue [discuss common criticisms], while others raise concerns about [mention ethical considerations].

Future Outlook and Trends of Cavazaque

Looking ahead, the future of Cavazaque appears promising. Emerging trends [speculate on future developments], indicating [mention potential areas of growth] and paving the way for [highlight future applications].

Conclusion

As we conclude our exploration of Cavazaque, one thing becomes clear: its enduring significance in a world of constant change. Whether in finance, technology, culture, or philosophy, Cavazaque remains a guiding light, illuminating the path towards a brighter, more enlightened future.

FAQs

- What does Cavazaque mean?

- Cavazaque refers to [provide definition].

- Where did Cavazaque originate?

- Cavazaque originated from [mention origin].

- How is Cavazaque applied in everyday life?

- Cavazaque can be applied in [discuss everyday applications].

- Are there any books or resources to learn more about Cavazaque?

- Yes, there are several books and resources available, including [mention books or websites].

- What are the criticisms against Cavazaque?

- Criticisms against Cavazaque include [discuss common criticisms or challenges].

General

Rzinho: Brazil’s Sensational Music Maestro

Hey music enthusiasts! Ever caught wind of Rzinho? This Brazilian melody maven is making waves globally, and you’re in for a thrill as we unravel the tale of football’s burgeoning sensation. From his grassroots in Rio’s favelas to soaring with Brazil’s national team, this insider’s guide unveils Rzinho’s past, skills, and what lies ahead. Delve into his dynamic playstyle, major milestones, and the anticipation as he conquers the world stage. Ready for the scoop on the next musical phenomenon? Get the full scoop on Rzinho—the one and only!

Table of Contents

- The Rzinho Chronicles

- Rzinho’s Musical Odyssey

- Rzinho’s Impact on Brazilian Music

- Rzinho FAQs

- Wrapping Up the Rzinho Saga

The Rzinho Chronicles

Introducing Rzinho

Get acquainted with Rzinho, the stage identity of Brazilian maestro Rivaldo Pereira da Silva. Born in 1990 amidst Rio de Janeiro’s favelas, Rzinho’s blend of hip hop, samba, and pagode struck a chord with fans early on.

Ascending to Stardom

At a mere 14, Rzinho’s freestyle video went viral, catching the eye of music producers. The release of “Sonho de Verão” in 2007 marked his meteoric rise, solidifying his stardom.

Philanthropic Endeavors

Despite fame, Rzinho champions his roots, advocating for marginalized communities. His contributions to healthcare, education, and job opportunities showcase his commitment to giving back.

Future Ventures

After a hiatus, Rzinho is back in the studio, working on new music. Fans eagerly await his next hit, anticipating the continuation of his socially-conscious samba and pagode.

Rzinho’s Musical Odyssey

Musical Genesis

Rzinho’s musical journey commenced in 2015 with YouTube and SoundCloud covers, gaining recognition for his soulful voice and guitar skills.

Discovery and Debut

In 2017, renowned producer Carlos Eduardo discovered Rzinho, leading to the release of his debut EP in 2019. The EP soared to number three on Brazil’s charts, propelling him to stardom.

Genre Fusion

Influenced by samba, pagode, axé, and forró, Rzinho’s music is a blend of energetic rhythms, celebratory vibes, and romantic melodies.

Rzinho’s Impact on Brazilian Music

Rediscovering Rzinho

Originating in the 1920s, rzinho, a Brazilian music genre, has roots in Rio de Janeiro. Its lively, romantic sound embodies the city’s cultural vibrancy.

Lyrical Palette

Rzinho’s lyrics revolve around love and humor, depicting Rio’s life. Composers like Donga and João Pernambuco popularized rzinho, shaping Brazil’s musical identity.

Enduring Legacy

Though rzinho declined, its influence persists in genres like samba and bossa nova, establishing Rio as Brazil’s musical hub.

Rzinho FAQs

Unveiling Rzinho

Rzinho, a Brazilian cheese bread, has become a global sensation. Discover the delicious details about this treat.

Gluten-Free Goodness

Yes, rzinho is naturally gluten-free, crafted from cassava flour for those seeking a gluten-free delight.

Savoring Rzinho

Designed to be eaten by hand, rzinho pairs well with coffee, juice, or cocktails, offering a warm, gooey center.

Homemade Happiness

Crafting rzinho at home is a breeze with simple ingredients – cassava flour, milk, eggs, cheese, and butter.

Wrapping Up the Rzinho Saga

And there you have it – the full exposé on Rzinho! From his roots in Brazilian funk to the dance craze among the youth, you’re now armed with everything about this rising star. Dive into the dancefloor, embrace the rhythm, and who knows – you might kick off the next viral Rzinho dance challenge!

General

Ilimecomix: Redefining the Comic Book Experience

Introduction:

Comics have evolved in the digital age, and iLimeComix is at the forefront of this transformation. This article explores how iLimeComix revolutionizes comics, offering a platform for creators, an interactive experience for readers, diverse content, and a community that fosters growth. As technology reshapes entertainment consumption, iLimeComix stands as a testament to the evolution of storytelling through visuals and words, ensuring the vibrancy of the comic book industry.

Table of Contents

- Ilimecomix Birth:

- The Journey of iLimeComix

- Choosing Diversity and The variety

- A Combination of Technology and Art:

- Establishing an Active Neighborhood

- Developing Future Talent

- Change on Cultural Trends:

- Comic Books and the Promotion of Mental Health

- Magical Story Points

- Working Together with Other Artists:

- Interactive Interaction with Fans

- The Universe of Ilimecomix

- A Universe Exploration:

- Features of iLime Comix Mainly

- Frequently Asked Questions

Ilimecomix Birth:

The Journey: Ilimecomix was born out of the creative minds of Mia and Lucas, fueled by a passion for illustration and storytelling. Their journey began with a desire to transcend traditional artistic limitations, resulting in a haven for their most outrageous fantasies.

A group of gifted writers, artists, and storytellers drives iLimeComix’s success. The intricate plots and eye-catching visuals showcase extraordinary creativity.

Choosing Diversity and The Variety: The success of Ilimecomix is attributed to its dedication to inclusivity and diversity. The comics represent a mosaic of human experiences, exploring ancient civilizations, futuristic landscapes, and magical realms, making it relatable to readers from all walks of life.

A Combination of Technology and Art:

Establishing an Active Neighborhood: At the core of Ilimecomix is a thriving community where readers, writers, and artists interact. Aspiring artists receive support, and readers participate in debates and fan theories, giving life to the stories inside the books.

Developing Future Talent: It’s actively develops new talent through competitions and events, fostering innovation and supporting the expansion of the comic book community.

Change on Cultural Trends:

Over time, Ilimecomix has transcended its webcomic origins, influencing various creative mediums and becoming symbols of empowerment.

Comic Books and the Promotion of Mental Health: It delicately weaves mental health advocacy into its stories, depicting the significance of resilience and support. Readers facing similar struggles find solace in the platform’s depiction of emotional complexity.

Magical Story Points: It’s captivating story arcs skillfully combine complex storylines, character growth, and surprising turns that keep readers on the edge of their seats.

Working Together with Other Artists:

Interactive Interaction with Fans: Fans actively contribute to the story through polls, surveys, and competitions. This level of interaction fosters a sense of ownership in the fictional world, strengthening the relationship between creators and their audience.

The Universe of Ilimecomix: It offers a clever and ridiculous playground, encouraging readers to embrace the absurd while delving into the unusual.

A Universe Exploration:

Features of iLime Comix, primarily:

- An eclectic assortment of comic books

- Interface That’s Easy to Use

- Possibilities for Customization

- Availability on Multiple Devices

Frequently Asked Questions:

- Are Ilimecomix exclusively published in Japanese?

- No, It is accessible to a wider audience with translations into English, Spanish, French, German, and Italian.

- Are there any intentions to adapt Ilimecomix in the future?

- While there haven’t been recent announcements, the ongoing appeal may result in more adaptations down the road.

- What distinguishes Ilimecomix from other comic books?

- It stands out with its distinctive blend of strange humor, unusual characters, and surprising narrative turns.

- How do I get content from Ilimecomix?

- It’s content is available in print, web comic book stores, TV shows, and motion pictures.

- Is Ilimecomix appropriate for all age groups?

- The humor is universally appealing, but some themes and jokes might be suitable for older readers.

-

General1 year ago

Orchard Grass (Dactylis glomerata): A Botanical Epic

-

Technology1 year ago

GPT66x: Boosting Talks with Transformer & Optimization

-

Lifestyle1 year ago

Fascinating World of ‘Cristoferideas’ and their Viral TikTok Video

-

Gaming2 years ago

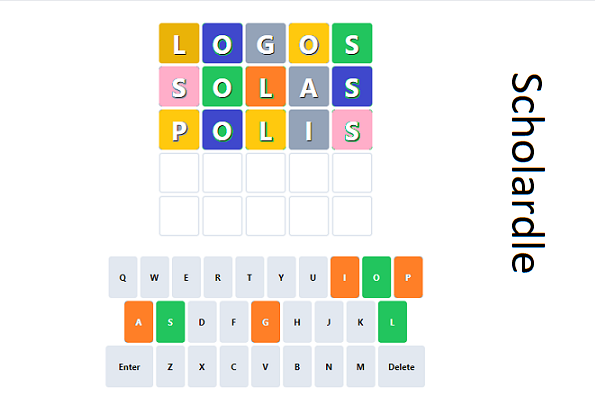

Scholardle: The Academic Word Guessing Game

-

Gaming1 year ago

Step Back in Time with Heardle 60s: The Ultimate Word-Search Puzzle Game

-

Lifestyle1 year ago

Meet Katie Sakov San Francisco’s Talented Writer and Editor

-

Gaming2 years ago

/zwzhanbf-ym: Unlocking the Mystery and technique to Decode it?

-

Blog1 year ago

Breathing New Life with Õygen Bioreactors: The Future of Oxygen Generation